Healthcare Resources and Considerations for Churches

Resources for Coverage

If you are the benefits coordinator for your group, or, if you are a one-employee organization responsible for your own coverage, consider contacting the following organizations:

Individual Healthcare Coverage Options

eHealthInsurance at www.ehealthinsurance.com or at 844-764-6386

Healthcare exchanges (or Marketplaces) under the Affordable Care Act (ACA) at www.healthcare.gov.

AARP Healthcare Options from United HealthCare (for those age 65 and older) at www.aarphealthcare.com or (800) 905-6061

Remodel Health at remodelhealth.com.

Medical Sharing Ministries (note: these are not insurance providers)

Samaritan Ministries at samaritanministries.org or 877-764-2426

Medi-Share at mychristiancare.org or 800-264-2562

Disclaimer: The above organizations are listed as options to consider when seeking medical coverage. Servant Solutions does not endorse participation with any particular organization.

Overview

Churches and non-profits are not exempt from the Affordable Care Act (ACA) just because they are a church or non-profit. There are numerous provisions including credits/notices and potential fees that apply to employers and individuals.

Employers with 50 or more full-time employees, including full-time equivalent (FTEs) employees are required to provide health insurance to FT employees. This is called the Shared Responsibility Rule or the ‘Play or Pay’ rule. Employers with less than 50 FTEs are not subject to the ‘play or pay’ rules and are not required by law to provide group health insurance.

For employers with fewer than 50 FTEs, which includes the vast majority of churches, there remain a number of options. The church, and the individual employees, must make decisions based on a number of factors, including, access to quality care and the desire to reduce tax liability (or cost), among other items. This will be a challenging decision on both parts.

Generally, all health insurance (employer-based or individually-based) must be ACA-qualified, meaning it is both: (a) affordable (premiums do not exceed 9% of household income), and (b) provides minimum essential coverage (ten categories of ACA-required coverage like preventive health benefits). However, there are exceptions for individuals, if one is enrolled in a medical sharing ministry plan (Medi-Share, etc.). While these are not medical insurance plans, if an individual is enrolled in one of these plans, the individual (or family) will not have to pay the “lack of ACA-qualified insurance” tax penalty. We provide other information about these plans below. However, having staff members enrolled in a sharing ministry plan does not exempt the employer from the ACA. If the employer has 50 or more FTEs, the employer is still required by law to provide ACA-qualified group medical coverage, or face a penalty.

Options

For larger employers, contact a group medical insurance agent. If the employer has more than 50 total employees, it is likely the employer must provide ACA-qualified group medical coverage. There are strict time and hour requirements so some organizations may “hit” the 50 full-time equivalent (FTE) number with a good bit fewer than 50 actual full time employees. Contact your insurance agent for more information.

For smaller employers and for individuals, there are many more options. Smaller employers are not required to provide health insurance, but most still wish to do so. It is likely highly advisable for most churches to continue to provide group medical coverage for those with staff sizes far fewer than the 50 number. How “small” one can be and still provide group coverage is a matter of law: two full time employees (30 hours a week or more) may purchase employer-based group medical coverage. So, within the 2 to 49 employee range, what will church employers decide to do? Due to Social Security laws, it is far more cost efficient for those with staff sizes of 20 or more to provide group coverage. And, for those with staff sizes of 10 to 20, it is likely easier to obtain deeper volume discounts with group coverage. For churches with fewer than 10 employees (most churches), there are several options.

Group coverage. As long as one employs two or more working 30 hours a week or more, there are group plans available.

Discontinue coverage. The ACA does not require small employers to provide coverage. While we doubt that any church will do this (and we do not recommend it), it is legal to do so.

Discontinue coverage and increase salaries. While the new higher salary will be taxable at standard income tax rates, this will give small organizations and their staff the flexibility to do what they want. Some staff may choose to pay the tax penalty. Others may opt for a sharing ministry plan. Still others may access an ACA marketplace plan, with or without tax credits. And there are other routes: access to other employer plans through spousal coverage; Medicare for those of retirement age; military or veterans benefits for those with eligibility; and even state Medicaid for certain dependent children.

Provide an ICHRA or a QSEHRA – see below for more information.

New in 2020

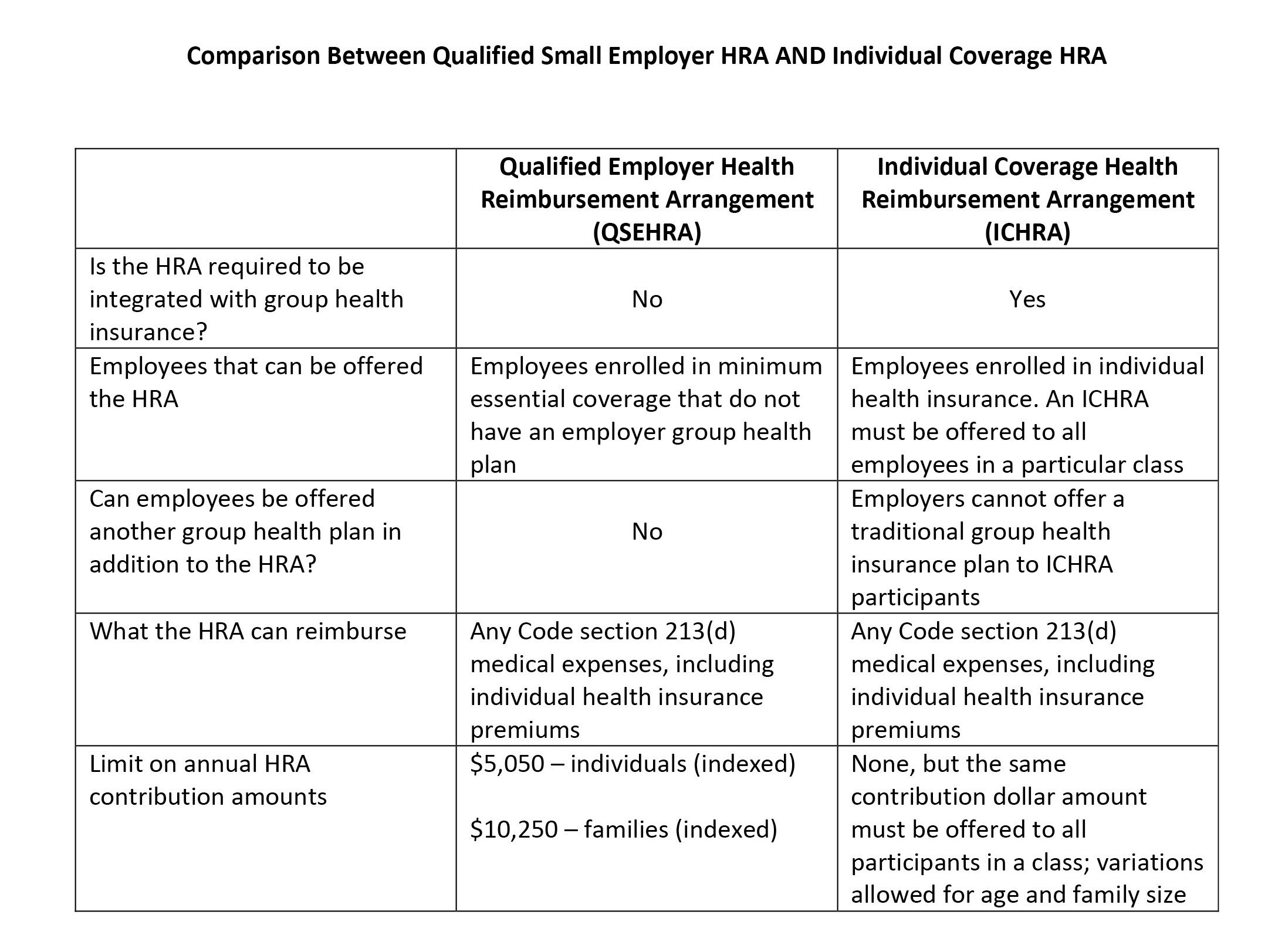

Individual Coverage Health Reimbursement Arrangement (ICHRA) Effective January 1, 2020 employers can offer an ICHRA as an alternative to traditional group health coverage, subject to certain conditions. ICHRA’s are individual, account-based health plan funded solely by an employer contribution which can be used to reimburse employees for cost of individual health insurance coverage and other eligible medical expenses on a pre-tax basis. You can read more about the ICHRA detail here.

For Employers, there are no minimum or maximum contributions required each year. An employer must offer the ICHRA on the same basis to all individuals within a class of employees. However, the amounts may be increased for older employees or employees with more dependents. It can be integrated with group health insurance. There are no annual contribution limits, but the same contribution dollar amount must be offered to all participants in a class. A definition of classes are described here.

For Employees, Health insurance coverage can be purchased through the exchange/marketplace or directly from an insurance company. It cannot consist of: (1) short-term, limited-duration insurance, (2) coverage consisting of only dental, vision or similar “excepted benefits” or (3) coverage provided under a health care sharing ministry. Employees participating in an ICHRA are not eligible for Affordable Care Act premium tax credits.

Establish a qualified small employer health reimbursement arrangement (QSEHRA). In December 2016 by the 21 Century Cures Act, the QSEHRA partially restores a route many smaller employers formerly used to provide employer payments for health insurance without increasing income taxes. However, the new QSEHRA has a number of caveats, including strict dollar limitations, a requirement of uniform access and applicability for all employees at the organization, and no ability to obtain ACA premium tax credits if the QSEHRA is used to purchase an ACA marketplace (ObamaCare) plan. An employer would need to speak with a local tax advisor to ensure this is setup appropriately.

Regardless of the route chosen, one must work within a range of several, sometimes competing alternatives: access to and desire for quality medical care, one’s ability to afford and most tax advantageous plan. Consult your personal tax advisor to work through these options.

A Word About Sharing Ministries

While medical sharing co-ops have been around for many years, their popularity “exploded” with the passage of the Affordable Care Act for many reasons. First, if one is enrolled in such a plan, there is no tax penalty for not having insurance. Second, since these are not insurance plans, they are exempt from most state and federal laws (and protections), which vastly reduces costs. Third, since they are largely unregulated, they can continue to do what some insurance plans used to do (laser coverage, restrict coverage, have higher or different limits, terminate coverage at any time, etc.). This means these plans are far cheaper (often 1/3 the price) of standard, “comparable” medical insurance. Servant Solutions does not offer a recommendation either way on these plans. We know many throughout the Christian community use these plans. They remain a valid consideration, but we strongly encourage you to review the benefits against the limitations before joining and participating.

Disclaimer

The material in this Toolbox series is provided as general information, education and guidance; it should not be construed as, and does not constitute, legal advice nor accounting, tax, or other professional advice or services on any specific matter. Readers should consult with their counsel or other tax professional advisor before acting on any information contained in this presentation.

In accordance with IRS Circular 230, we hereby inform you that any U.S. federal tax advice contained in this document (including any directed links) is not intended or written to be used, and cannot be used for the purpose of (i) avoiding penalties under the Internal Revenue Service Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

Updated 6-4-2020